by Brian de Lore

Published 8th May 2020

Better late than never, but Wednesday’s announcement by RITA that it’s finally decided to reduce costs is a classic case of ‘too little, too late.’

It may be a short-term respite for RITA’s chronic cash-flow condition, but it neither addresses the long-term competitiveness of the racing industry in any shape or form and nor will it off-set the expected substantial decline in code distributions, hence the pending prizemoney decline for 2020-21.

That predicament is notwithstanding RITA’s application to Treasury for a COVID-19 bailout for a figure purported to be $80 million. Should it be approved with Minister Peters giving it his solid support, the bank debt of $45 million and current liabilities might be covered, but it would leave little for anything else.

The brief COVID-19 Update which appeared on the RITA website on Wednesday, states: “The proposal includes a reduction of approximately 30 percent of roles across all areas of the organisation and is in addition to other cost-saving measures aimed at reducing total expenditure.”

NZ Rugby has announced job losses for its full-time staff of 180 at 50 percent, with the remaining 50 percent having to reapply for their roles.

According to New Zealand employment law, the proposed cuts will have to be presented to staff for consideration, then be up for discussion with feedback taken before the final decision in late May. NZ Rugby has announced job losses for its full-time staff of 180 at 50 percent, with the remaining 50 percent having to reapply for their roles.

NZ Rugby lost more than $7 million last year but is estimating a fall in revenue this year of around $100 million. By comparison, NZRB/RITA lost $28.5 million last financial year, and increased bank debt, but did nothing about its ridiculously top-heavy employee level. It has carried them through to May 2020 where they have reached the point of no choice.

When NZRB became RITA on July 1st last year, a great opportunity existed for the widest Bunnings broom to go through and clear out the blatantly obvious deadwood and instill some confidence in the stakeholders of racing. A great opportunity missed, and ever since, the rise in debt is paralleled only by the decline in industry morale.

Wednesday’s Update from RITA clearly blames COVID-19. Executive Chair Dean McKenzie is quoted as saying, “The TAB has taken a major hit from COVID-19 with revenue last month 47 percent below forecast and customer numbers down more than 35 percent.

“Despite far reaching efforts to reduce costs across the TAB, including salary reductions, staff taking leave and reducing all non-essential expenses, it simply was not enough to offset the blow COVID-19 has had, and will have, on our industry.” – Exec Chair Dean McKenzie

“Despite far reaching efforts to reduce costs across the TAB, including salary reductions, staff taking leave and reducing all non-essential expenses, it simply was not enough to offset the blow COVID-19 has had, and will have, on our industry.”

My version is quite different. RITA was insolvent before COVID-19 turned up. It’s a simple matter of tangible assets failing to equal the size of the mounting bank debt. And while revenue might be down 47 percent as claimed by McKenzie, having no New Zealand racing since the day Alert Level 4 commenced has meant having to make no payments to the codes for stakes money. Then, with the wages subsidy supplementing salaries, the TAB has been accepting bets on Australian racing on a ‘betting information use charge’ – a far less onerous form of conducting business.

McKenzie goes on to say, “The reality is the TAB will need to be a leaner, more efficient business with fewer roles, and focused on driving our core wagering and gaming business.” Why wasn’t he heard to say that last July?

The Update concludes rather tersely with, “No further comment will be made until a final outcome is confirmed.” It’s a relatively short Update that fails to mention the monetary savings which would accrue from the downsizing which is the most important figure.

…it would be surprising if savings annually on this move exceeded $10 to $12 million or only five percent of the total costs.

Thirty percent of roles sounds significant but given they have 700-odd employees including the RIU which doesn’t include consultants which numbers 70 in this cost-cutting measure, it may not make too much of a dent on the total running costs of 2019 which amounted to $211 million. Drawing information from the Annual Report and last SOI, it would be surprising if savings annually on this move exceeded $10 to $12 million or only five percent of the total costs.

In the Budget of 2019, the Government provided $3.5 million to the racing industry to: “make the best use of the $3.5m Crown contribution to the cost of industry change ensuring that this funding buys change.”

Has the $3.5 million been used for anything yet or saved for this RITA debut of cost-cutting, which seems unlikely given the parlous state of its financial position over the past year. We don’t know – RITA has never mentioned it.

Racing needs a revolution with a business-savvy leader to get rid of the deadwood, address the skill level required, understand IT on a global level, and deliver a balance sheet for New Zealand’s racing future. No sign of it yet!

The Deloitte Report was dismissed out of hand by an NZRB which adopted a contemptible ‘we know better’ attitude towards the codes.

The Deloitte Report is now three years old (May 2017) but is as relevant now as it was then – it was authoritative but was dismissed out of hand by an NZRB which adopted a contemptible ‘we know better’ attitude towards the codes. Deloitte had significant experience in the thoroughbred business and drew upon its Australian expertise to compile the report.

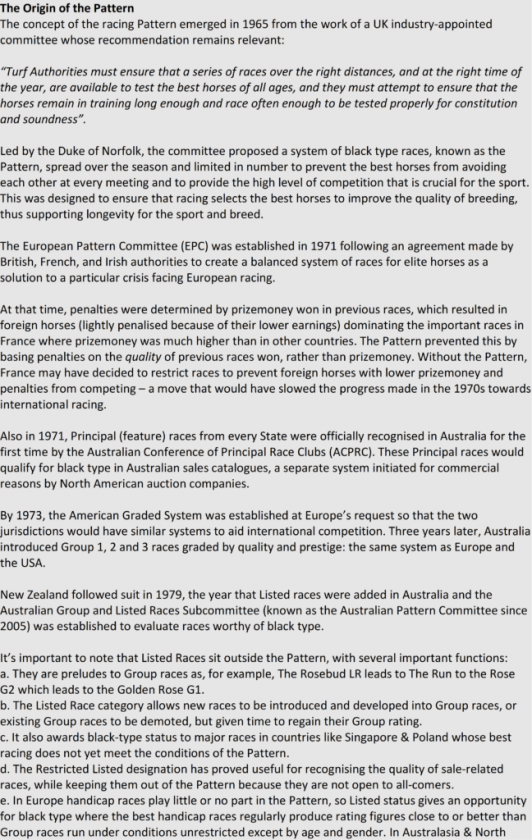

Deloitte said: “The lack of scale means it is unlikely NZRB will be able to achieve a sustainable competitive advantage against international wagering competitors. Based on our experience of the benefits achieved with industry consolidation in other settings and our analysis of the NZRB current cost structure, we are of the view material cost synergies would be achievable if a more substantive outsourcing or similar initiative were to be pursued with an appropriate party. Our initial assessment is that gross annual benefits could be in the vicinity of $63 million.

Since NZRB ignored that advice, the racing industry in New Zealand is something like $250 million worse off when you take into account the lost opportunity and a commitment towards a $50 million FOB platform plus ongoing deals with Openbet (10 years) and Paddy Power-Betfair (5 years). That may have been about the time they made the movie, Dumb and Dumber.

The RITA SOI (Statement of Intent ) released last November stated: “We are optimistic this result (previous year) will be a one-off and we will deliver on our forecasted net profit in 2019/20 of $165.8 million.” That budget currently looks like missing by $55 million or so with a bottom-line result of between $100 million and $110 million. They can blame COVID all they like but the industry isn’t that dumb, or dumber, to swallow that one.

We only have to go back and compare New Zealand with Western Australia to realise what a pig in the trough scenario we have endured.

The 2019 Annual Report says NZRB/RITA spent $22,500 per week on consultants. Travel and Accommodation amortised out at $54,000 per week. Other expenses were totalled up at $14.25 million or $273,396 per week. In the notes to discover what they were, the list is shown but the final item reads as ‘Other Operating Expenses, ’ which is $2,047,000 or $39,400 per week.

To have ‘Other Expenses’ and then a sub-title under that listing another ‘Other Operating Expenses’ which amounts to $39,400 per week with no notes as to how the money was spent, is symptomatic of the lack of proper accounting, transparency and accountability to which the participants of New Zealand racing have been subjected to for many years.

Finally, have a look at what happens in Western Australia to which I have made comparisons on numerous previous occasions. RWWA (Racing and Wagering Western Australia) has one organisation running wagering and racing whereas New Zealand has five. Under RWWA’s board they have five committees. By their own admission they believe it’s far from perfect, but compared to NZ, WA is efficient.

| NZ Racing (2019) | Racing Western Australia (RWWA) (2019) |

|

| Net Betting Margin | $285m | $305m |

| Salary & Wages | $63m | $40m |

| Employees | ~700 | 370 |

| Senior Managers (Note 1) | 23 | 7 |

| Margin/employee (Note 2) | $400k | $800k |

1. NZTR, NZ Harness, NZ Greyhounds and the RIU do not disclose salary information for senior managers. For the purposed of comparison with RWWA have assumed two managers each paid $200k

2. Key racing industry efficiency and competitiveness measure

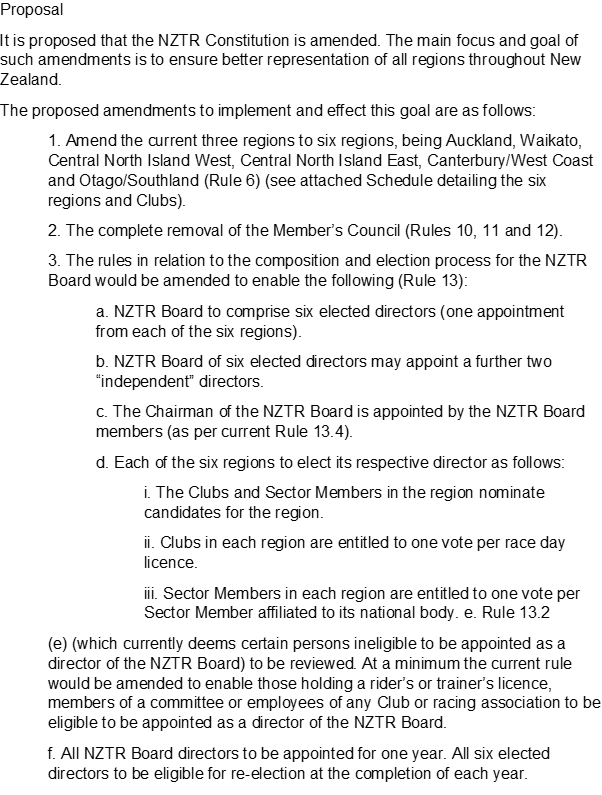

| New Zealand | Western Australia | |

| Population | 4.886m | 2.589m |

| No. race meetings | 311 | 283 |

| No. races | 2,582 | 2,140 |

| No. starters | 4,744 | 3,197 |

| $Loss for $2018-19 | ($28.5m) | ($3.12m) |

Footnote:

The Optimist has learned that a pre-budget announcement will be made next week by our Minister of Racing, the Rt Honourable Winston Peters. I am told it is big and a game-changer for the industry. Could it be about the bail-out application? Might it be fake news? On the previous form on big announcements, in a head to head it’s $2.60 on the loan approval and $1.40 on the fake news. All bets accepted as soon as my betting license arrives.

The post RITA forced into action but have waited too long appeared first on .